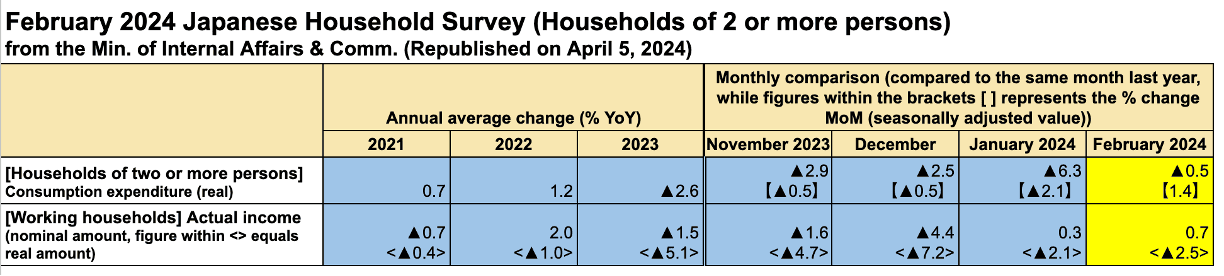

February marked the 17th consecutive month of declines in Japanese household earnings on a real basis, taking inflation into consideration

According to the Ministry of Internal Affairs and Communications' April household survey, real earnings for households with two or more people fell by 2.5% year-over-year in April 2024, marking the 17th consecutive month of decline. This comes even as the Nikkei reported that Rengo, Japan's largest union confederation, secured wage increases exceeding 5% for its members in the spring 2024 negotiations.

The survey data suggests that these gains haven't translated broadly across the workforce. While some new graduates saw eye-catching percentage increases in starting salaries, the reality for many households is a struggle to keep up with rising living costs. An extra $100 per month may offer some temporary relief, but it falls short of what's needed to maintain a comfortable lifestyle, let alone save for a home, travel, or major purchases.

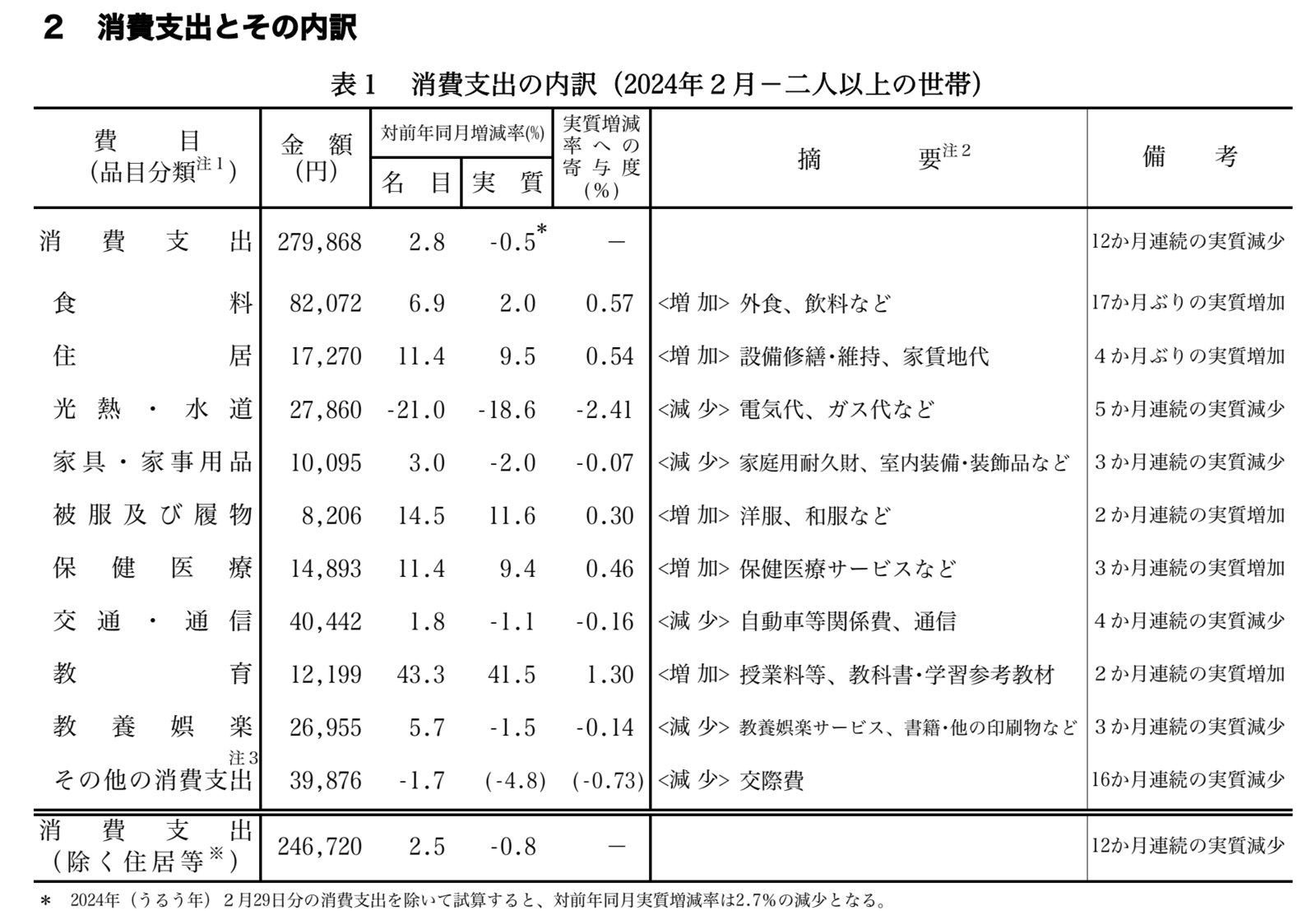

The situation is further compounded by escalating inflation. Food costs, a significant expense for most households (accounting for roughly 30% of income), have risen for 17 consecutive months in real terms. Additionally, living-related expenses, including maintenance, management, and renovation fees, have climbed 9.5% year-over-year in real terms (over 11% nominally) compared to February 2023.

This persistent disparity between wage growth and inflation threatens to dampen domestic consumption, a key driver of the Japanese economy.

Adding to concerns about the nation's economic health, household consumption in Japan has contracted for twelve consecutive months on a real basis. This extended decline coincides with a wave of price hikes implemented by businesses across various sectors. Companies grapple with rising import costs, wages, and raw material expenses, which they are increasingly passing on to consumers. This squeeze on purchasing power is likely to disproportionately impact middle-class households, potentially jeopardizing the long-held image of Japan's superior quality of life.

The ongoing erosion of consumer spending threatens to dampen economic growth and heighten concerns about long-term stagnation. The government will need to monitor the situation closely and consider potential policy responses to ease the burden on households and stimulate broader economic growth. Please do leave a comment below on what you would do if you were Mr. Ueda, the current Governor of the Bank of Japan, or better yet, Mr. Yukio Kishida, the Prime Minister of Japan. Love to hear your thoughts!